Formula SAE is an engineering design competition for university students, with iterations all around the world. Teams design, engineer, fabricate, fund and project manage their owns entries, providing a challenge across multiple disciplines. Australia’s version for 2014 was held at Melbourne’s Calder Park in December, with 22 entries from Australia and all around the world.

The design premise involves the challenge of producing a formula style racing car prototype for theoretical mass production. Design considerations include engine, suspension, aerodynamics, weight and safety.

If you’re interested, the Formula SAE Rule Book can be downloaded by clicking here… Formula SAE Rule Book

Monash University has had a virtual lock on the event since 2009 and took out top honours again in 2014.

Static Events

Presentation: Monash University

Cost: Tokyo Denki University

Design: Monash University

Dynamic Events

Acceleration: Edith Cowan University

Autocross: Monash University

Skidpad: Monash University

Endurance: Monash University

The bulk of those involved in Formula SAE projects are studying engineering disciplines. Formerly, many of these would be looking to transfer into the automotive design sphere upon graduation. Although Australia’s automotive manufacturing industry is not much longer for this world, the skills, professionalism, competition and networking involved for participants from this event will ensure that it is around for many years to come.

2015 will mirror 2014 for the Australian mechanical power transmission industry, in that times are not easy and the whole sector is reliant upon the economy overall. A lot of PT manufacturers have operations in Australia, and the next two years are shaping up as being critical on their future in this country.

Here’s a random list of what will be important for the power transmission industry this year.

Fluctuating currencies have always played a part in the Australian power transmission supply landscape. Lately, a sustained period of high Australian dollar valuation has kept a lid on pricing issues from manufacturers of imported power transmission equipment.

Price increases from power transmission manufacturers who deal in USD might be expected, with the AUD to USD exchange rate dropping significantly in only the past few moths.

Manufacturers of European power transmission equipment or companies who receive payment in Euros will have less call to increase prices, with the AUD to Euro exchange rate being relatively stable since mid-2013.

On the flip side of the coin, relief for manufacturing exporters from the weaker dollar may at least let them keep fighting on the world stage.

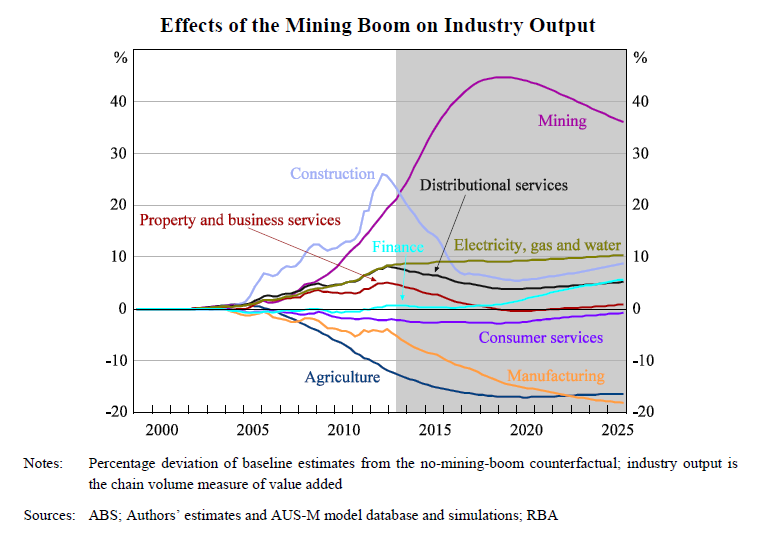

The sustained mining investment boom has been beneficial overall to the Australian economy, increasing real household disposable income per capita by an estimated 13%.

The benefits at the top end definitely haven’t been experienced across all industries, however, as the mining boom has undoubtedly hastened the steady decline in manufacturing experienced since 2008.

As far as the mechanical power transmission industry is concerned, power transmission manufacturers have wholeheartedly supported the mining industry’s premier trade show AIMEX, forsaking nearly all support for National Manufacturing Week and its more generalised manufacturing focus. They may have been right in doing this, for during the mining investment phase, expenditures continued to remain very strong.

The mining operation phase (that most projects have transitioned to) obviously requires much less capital expenditure and little maintenance expenditure whilst the plants are still new. As a result, we will see National Manufacturing Week regain support from the PT manufacturers as they look to regain a footing on industries with expenditure.

This time last year, Ford and Holden had both recently announced that they would be ceasing local manufacturing operations, with Toyota still yet to make a decision. Toyota’s decision to join the others in the manufacturing retreat came in February.

With no automotive manufacturing operations in Australia at all from 2017 (and demand for cars made locally until the closing date drying up very quickly) a big hole in overall manufacturing capacity will play a part in reducing total demand for PT equipment.

The federal government’s Automotive Diversification Program aims at helping automotive components manufacturers to find ways to innovate to find new products and markets. We are yet to see any real gains from the initiative.

The Collins-class submarine replacement as well as continued naval warfare capability are all coming into question for ships manufactured in Australia. Issues such as economy of scale for manufacturing, total demand by the navy, ramp-up costs and even ship performance have forced the federal government to look at alternatives to simply signing the cheques for ASC to take the contract.

Obviously, importing Australia’s warships would have a detrimental effect on the Australian mechanical power transmission industry.

The food and beverage manufacturing industry remains strong and continues to expand. Both local consumption and export demand is on the rise and manufacturers are making this industry sector one of their clear areas of concern. This should remain the case for the foreseeable future, although some individual producers have been finding things tough or retiring entirely.

Electric motor efficiency and continual improvement will shape product offerings from key manufacturers, who now fully embrace efficiency’s importance to sales.

So there it is, a random, non-comprehensive list of things that will play a part in the mechanical power transmission industry in the coming year. Unfortunately, most factors cannot be planned for or mitigated against as they are macro-economic concerns, so we will see how things play out in due course.

This ‘could’ be the new All Torque Transmissions corporate brand video.

A drop of 3.2 points saw the Australian Industry Group / PriceWaterhouseCoopers Performance of Manufacturing Index return to negative territory again in December.

Recording a 46.9, it was the same individual sectors that expanded and contracted from the last reporting period.

Positive news is starting to filter it’s way through the manufacturing sector, however, with the weakening Australian dollar helping manufacturing exports to record an expansionary 51.0. In fact, 7 of the 12 reporting periods for 2014 were expansionary in this sub-sector.

Even though there was an overall contraction, four sectors still expanded whilst the other four contracted. This ‘4 & 4’ result has occurred over the past few reporting periods.

The food, beverages & tobacco and non-metallic mineral products sectors where by far the standout performers, increasing from even November’s very strong results.

Although still expanding, the wood and paper products sector experienced a 10-point reduction.

To download a two page précis of the report, click here… PMI December 2014

With more than 200 individual models in the range, KB Electronics has been on the sharp side of variable speed drive technology in both AC and DC for many years. Renowned for being both well-built and easy to operate, KB’s DC drive range is still vast enough that it does require some navigating when selecting the correct unit for the application.

With more than 200 individual models in the range, KB Electronics has been on the sharp side of variable speed drive technology in both AC and DC for many years. Renowned for being both well-built and easy to operate, KB’s DC drive range is still vast enough that it does require some navigating when selecting the correct unit for the application.

This is where the KB Electronics DC Drive Selector comes in.

Encompassing the full range of KB’s DC drives; starting with chassis mount and working through NEMA1 and NEMA4X enclosures, as well as speed control accessories, the KB Electronics DC Drive Selector gives a broad technical snapshot of each drive. This allows for model comparison and assists with model selection.

As KB drives are made in the US, some variants are not available as supply from stock items in Australia. Something to keep in mind.

Follow the link to download the guide here… DCSelectionGuide